ESG Regulatory Compliance

ESG (Environment, Social, Governance) has become a vital issue for

companies to integrate into their business strategies and operation.

Companies are expected to disclose more ESG information in

compliance with market or governmental regulations.

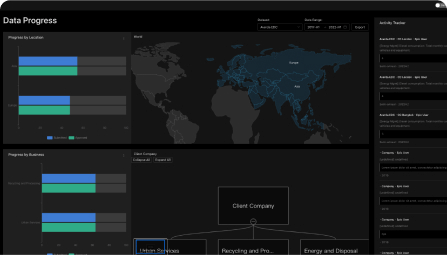

Seneca ESG is here to offer you practical tools and all the latest resources

required to comply with ESG regulations.